For Tax Experts Who Can’t Afford Mistakes

Protect Your Tax Practice From IRS Audits, Penalties & Fines — Before It’s Too Late

watch the video below

Join the free live masterclass

And discover how to stay compliant, avoid $63,500 in fines, and set up audit-proof systems that protect your livelihood.

4th October @ 12:00 PM CTS

For Tax Experts Who

Can’t Afford Mistakes

Protect Your Tax Practice From IRS Audits, Penalties & Fines — Before It’s Too Late

watch the video below

Join the free live masterclass

And discover how to stay compliant, avoid $63,500 in fines, and set up audit-proof systems that protect your livelihood.

4th October @ 12:00 PM CTS

Live compliance strategies

Simple steps to safeguard your practice

Free to attend — limited spots

Live compliance strategies

Simple steps to safeguard your practice

Free to attend — limited spots

Inside This Free Masterclass You’ll Learn How To:

Spot the red flags the IRS targets

Document returns the right way every time

Respond to audit letters with confidence

Set up audit-proof compliance systems

Avoid the costly mistakes most tax pros make

Inside This Free Masterclass You’ll Learn How To:

Spot the red flags the IRS targets

Document returns the right way every time

Respond to audit letters with confidence

Set up audit-proof compliance systems

Avoid the costly mistakes most tax pros make

still thinking?

After This Masterclass, You’ll Walk Away With:

A clear plan to protect your practice from IRS fines and penalties

You’ll know the exact compliance steps to follow so you don’t risk $635 fines stacking up to $63,500.

Confidence in your systems — no more guessing if you’re compliant

Instead of second-guessing every return, you’ll have proven audit-proof processes you can trust.

Step-by-step process to handle audit letters without stress

If the IRS ever sends a notice, you’ll know how to respond quickly and correctly — without panic.

Peace of mind knowing your documentation can withstand review

No more sleepless nights. You’ll leave with a checklist that ensures your files are protected.

A stronger, safer practice you can grow without fear

With compliance handled, you can focus on serving more clients and scaling your business.

still thinking?

After This Masterclass,

You’ll Walk Away With:

A clear plan to protect your practice from IRS fines and penalties

You’ll know the exact compliance steps to follow so you don’t risk $635 fines stacking up to $63,500.

Confidence in your systems — no more guessing if you’re compliant

Instead of second-guessing every return, you’ll have proven audit-proof processes you can trust.

Step-by-step process to handle audit letters without stress

If the IRS ever sends a notice, you’ll know how to respond quickly and correctly — without panic.

Peace of mind knowing your documentation can withstand review

No more sleepless nights. You’ll leave with a checklist that ensures your files are protected.

A stronger, safer practice you can grow without fear

With compliance handled, you can focus on serving more clients and scaling your business.

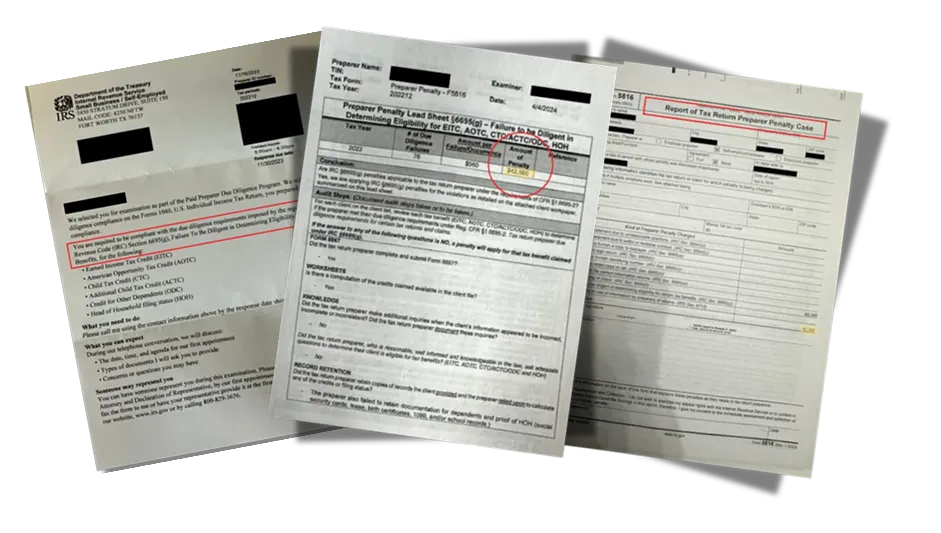

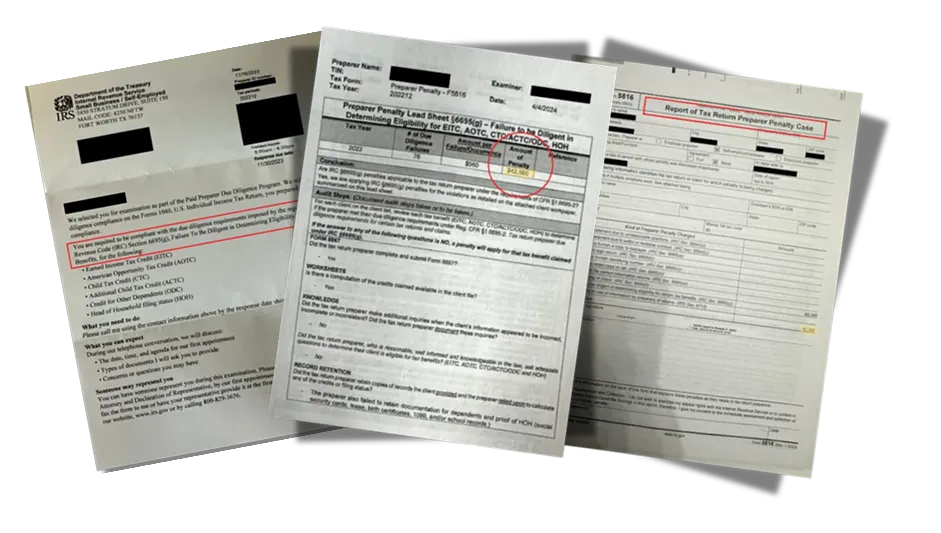

DID YOU KNOW?

The IRS can fine you $635 per mistake — which adds up to $2,540 on a single return with multiple credits?

Those fines can climb as high as $63,500 across just 25 clients — wiping out an entire season’s profit?

Even small documentation errors or missing forms can trigger criminal charges that put your practice and reputation at risk?

The truth: it’s not enough to just “do your best.”

You need systems and proof in place — or you’re exposed.

DID YOU KNOW?

The IRS can fine you $635 per mistake — which adds up to $2,540 on a single return with multiple credits?

Those fines can climb as high as $63,500 across just 25 clients — wiping out an entire season’s profit?

Even small documentation errors or missing forms can trigger criminal charges that put your practice and reputation at risk?

The truth: it’s not enough to just “do your best.”

You need systems and proof in place — or you’re exposed.

These IRS notices could hit your mailbox.

Would you know how to respond?

These IRS notices could hit your mailbox.

Would you know how to respond?

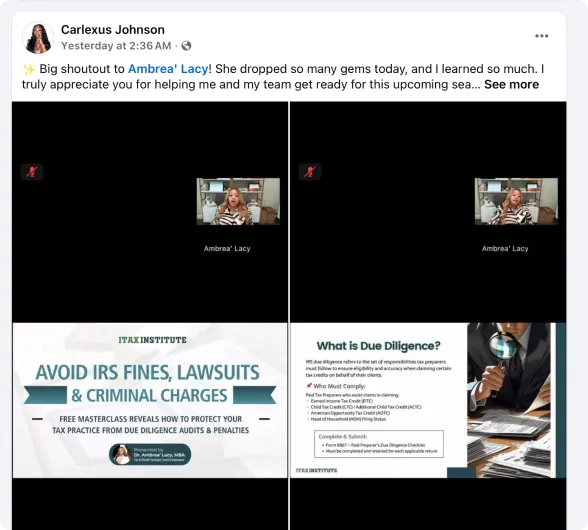

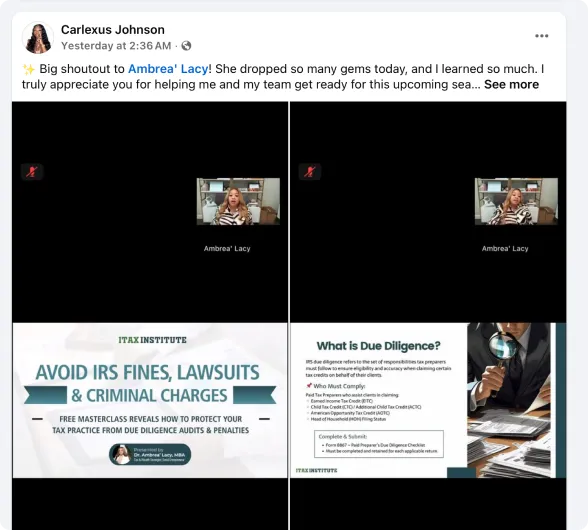

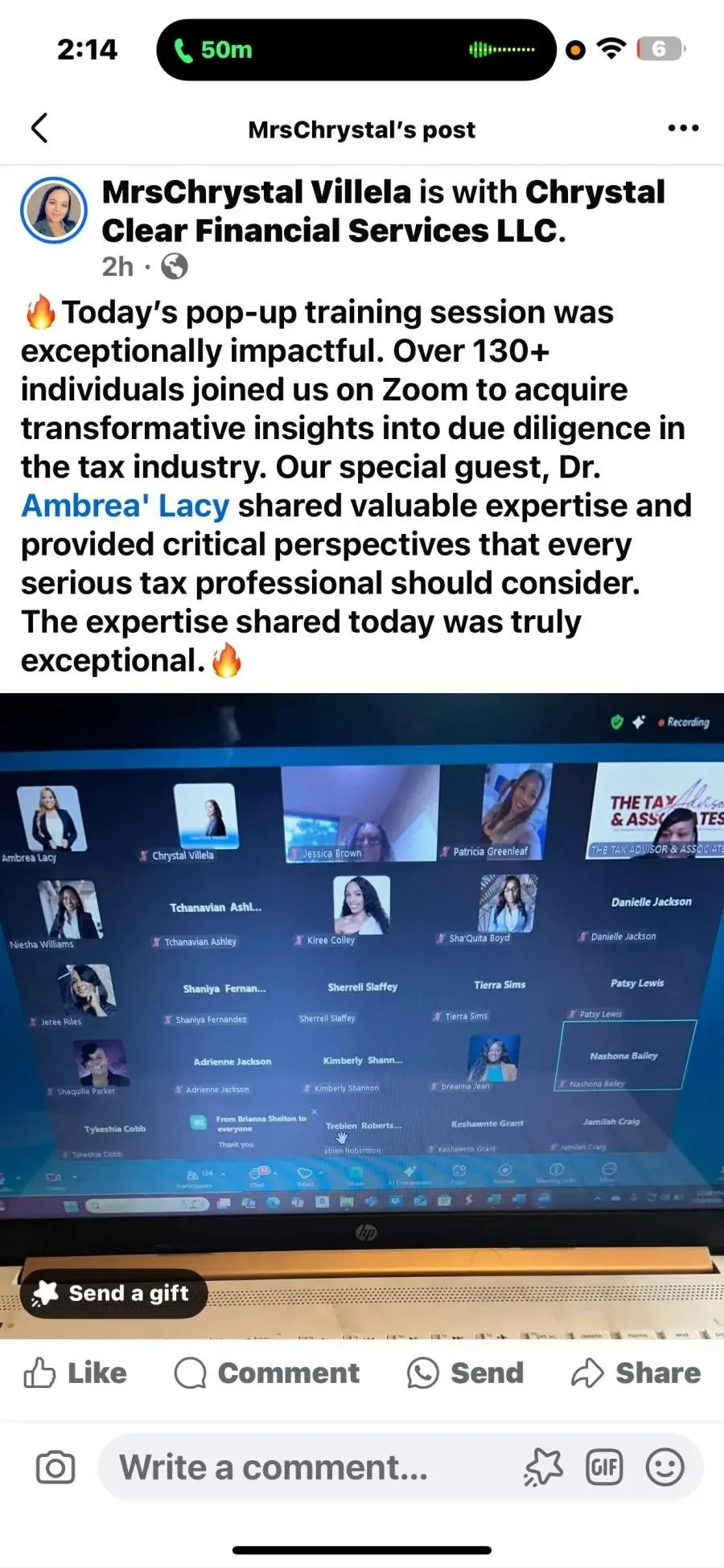

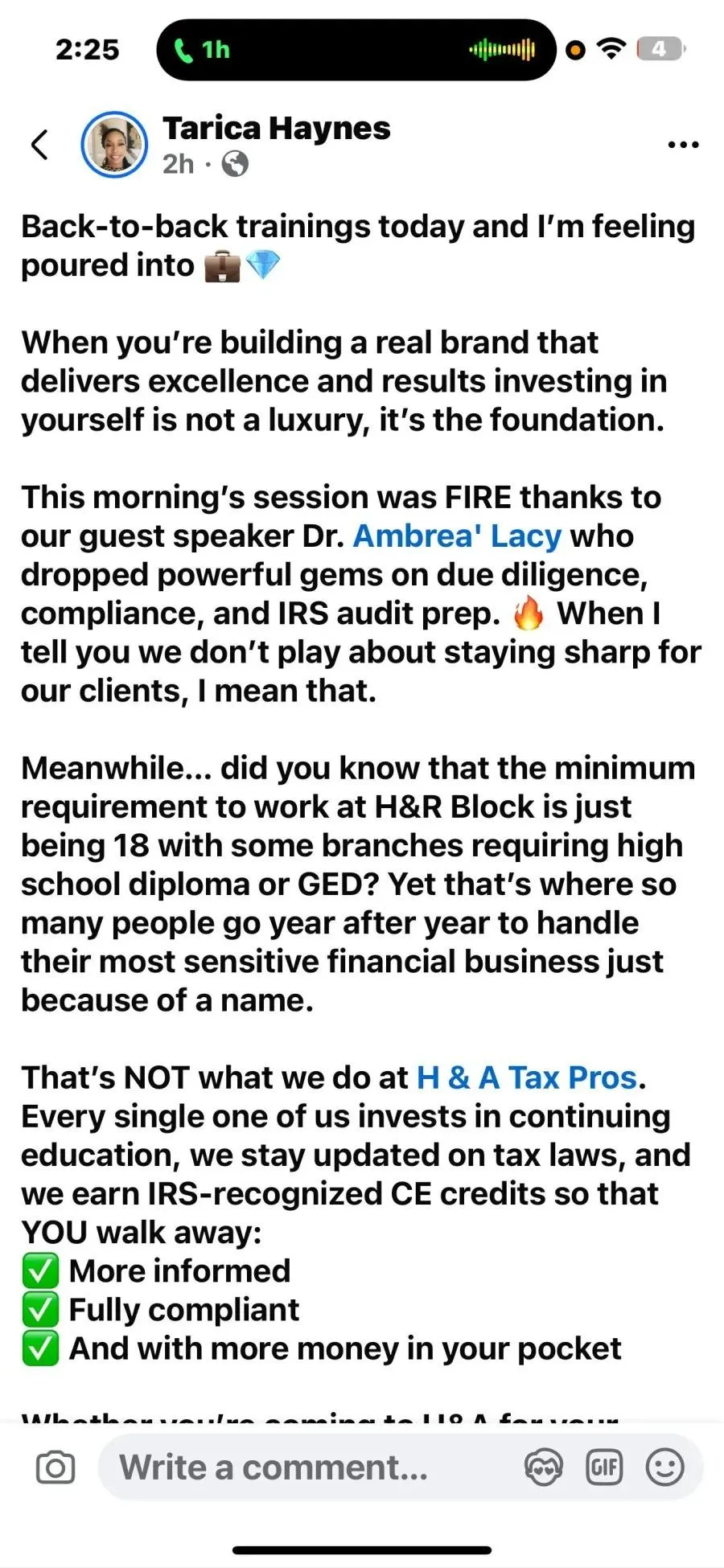

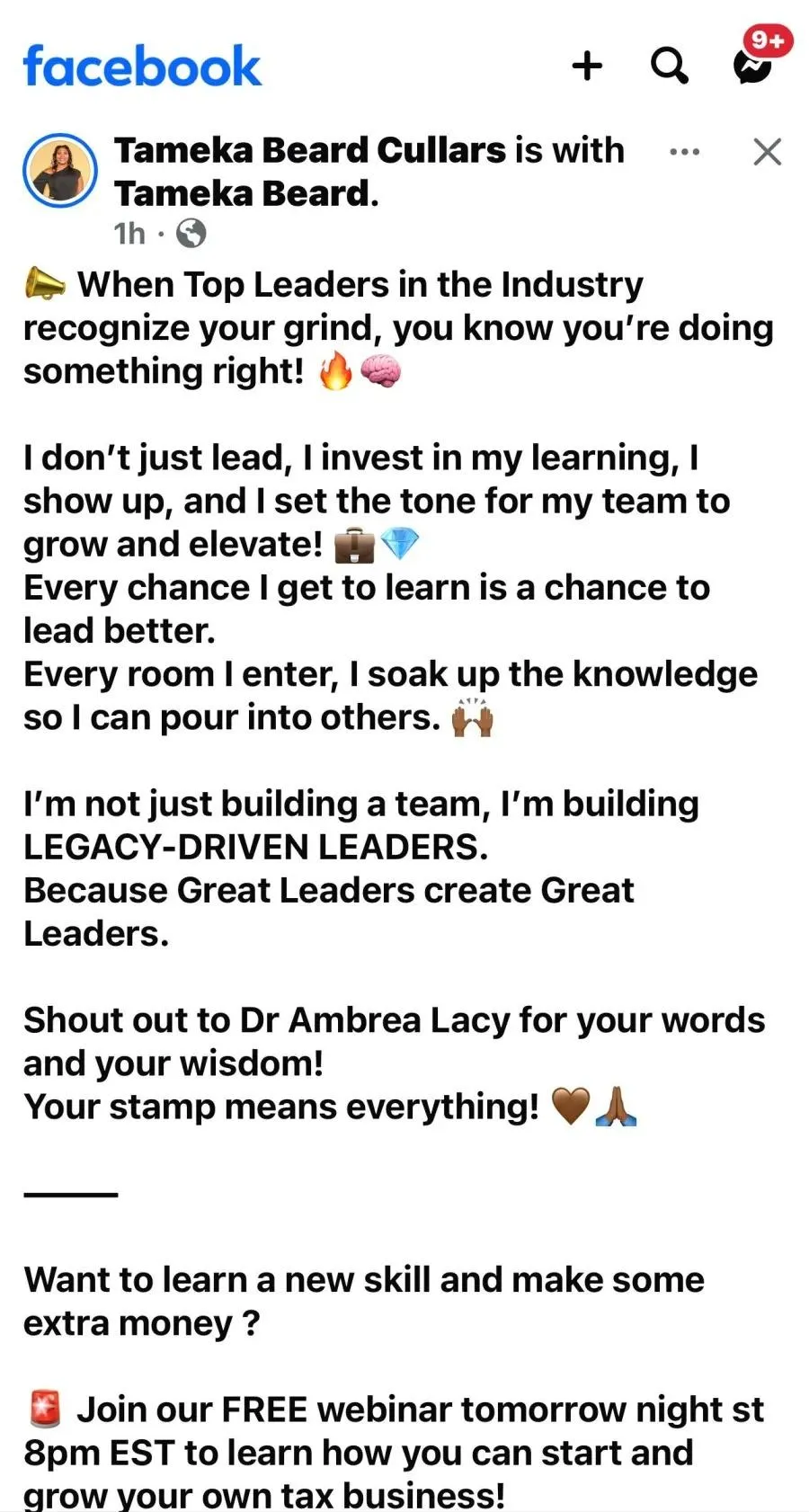

See How Tax Pros Transformed Their Practice in One Masterclass

Real professionals share how they went from worried about audits to confident in their compliance and systems.

See How Tax Pros Transformed Their Practice in One Masterclass

Real professionals share how they went from worried about audits to confident in their compliance and systems.

meet your host

dr ambrea lacy

With over a decade in the tax industry, Dr. Ambrea’ has guided hundreds of preparers to grow profitable, compliant practices.

She’s not just teaching theory. As the founder of a leading tax software company, she’s built real-world systems that help professionals document returns, pass audits, and scale with confidence.

HER MISSION IS SIMPLE

Protect tax professionals from losing their livelihood — while helping them grow their business the right way.

Whether you’re a new preparer or an experienced pro, Dr. Ambrea’ brings the tools, knowledge, and mentorship you need to stay safe, compliant, and profitable.

meet your host

dr ambrea lacy

With over a decade in the tax industry, Dr. Ambrea’ has guided hundreds of preparers to grow profitable, compliant practices.

She’s not just teaching theory. As the founder of a leading tax software company, she’s built real-world systems that help professionals document returns, pass audits, and scale with confidence.

HER MISSION IS SIMPLE:

Protect tax professionals from losing their livelihood — while helping them grow their business the right way.

Whether you’re a new preparer or an experienced pro, Dr. Ambrea’ brings the tools, knowledge, and mentorship you need to stay safe, compliant, and profitable.

Still Wondering If This Masterclass Is For You?

Here are the most common questions tax professionals ask — answered up front.

Who is this LIVE FREE Due Diligence Masterclass for?

This training is designed for tax professionals at all levels who want to stay compliant, protect their businesses, confidently handle IRS audits, and avoid due diligence penalties of up to $63,500.

When and where is the FREE Due Diligence Masterclass?

The Masterclass is FREE and hosted LIVE every Thursday at 12:00 PM CST on Zoom. You can join from anywhere. Once you register, you’ll receive your access link.

👉Reserve your free spot now and invite another tax professional who needs this training too.

Why should I attend this FREE Due Diligence Masterclass?

Because IRS due diligence mistakes can cost you up to $63,500 in penalties. This free training will show you exactly what the IRS expects, how to protect your business, and how to document properly so you can handle audits with confidence and keep more of your hard-earned money.

How long is the Masterclass?

The session lasts about 60–90 minutes and is packed with real-world examples, step-by-step guidance, and actionable strategies you can use right away.

Can I watch the Masterclass later if I miss it?

This masterclass is live only and will not be recorded. To get all the critical information and strategies, you need to attend at the scheduled time. Don’t miss your chance to join live!

Where can I get more resources after the Masterclass?

We’ve created ebooks and guides filled with tools, templates, and strategies you can start using right away.

Can I get personalized help?

Yes! You can book a free one-on-one consultation to discuss your specific challenges and get guidance tailored to your practice. If you want a personalized and intimate due diligence coaching session for your team, or prefer learning with others, you can also inquire about our group coaching programs to apply best practices alongside other tax professionals.

👉Book your Free Consultation or Learn More About Group Coaching

Still Wondering If This Masterclass Is For You?

Here are the most common questions tax professionals ask — answered up front.

Who is this LIVE FREE Due Diligence Masterclass for?

This training is designed for tax professionals at all levels who want to stay compliant, protect their businesses, confidently handle IRS audits, and avoid due diligence penalties of up to $63,500.

When and where is the FREE Due Diligence Masterclass?

The Masterclass is FREE and hosted LIVE every Thursday at 12:00 PM CST on Zoom. You can join from anywhere. Once you register, you’ll receive your access link.

👉Reserve your free spot now and invite another tax professional who needs this training too.

Why should I attend this FREE Due Diligence Masterclass?

Because IRS due diligence mistakes can cost you up to $63,500 in penalties. This free training will show you exactly what the IRS expects, how to protect your business, and how to document properly so you can handle audits with confidence and keep more of your hard-earned money.

How long is the Masterclass?

The session lasts about 60–90 minutes and is packed with real-world examples, step-by-step guidance, and actionable strategies you can use right away.

Can I watch the Masterclass later if I miss it?

This masterclass is live only and will not be recorded. To get all the critical information and strategies, you need to attend at the scheduled time. Don’t miss your chance to join live!

Where can I get more resources after the Masterclass?

We’ve created ebooks and guides filled with tools, templates, and strategies you can start using right away.

Can I get personalized help?

Yes! You can book a free one-on-one consultation to discuss your specific challenges and get guidance tailored to your practice. If you want a personalized and intimate due diligence coaching session for your team, or prefer learning with others, you can also inquire about our group coaching programs to apply best practices alongside other tax professionals.

👉Book your Free Consultation or Learn More About Group Coaching

Ready To Protect Your Tax Practice — Before It’s Too Late?

The IRS isn’t slowing down on audits. Every return you file without proper due diligence puts your business at risk.

This Free Masterclass gives you the systems and confidence to stay compliant and profitable.

One hour now could save you thousands later.

Ready To Protect Your Tax Practice — Before It’s Too Late?

The IRS isn’t slowing down on audits. Every return you file without proper due diligence puts your business at risk.

This Free Masterclass gives you the systems and confidence to stay compliant and profitable.

One hour now could save you thousands later.

100% free live training

Hosted by Dr. Ambrea’ Lacy

Limited spots — don’t wait

100% free live training

Hosted by Dr. Ambrea’ Lacy

Limited spots — don’t wait

© 2026 ITAX Institute

© 2026 ITAX Institute